10 Affordable Places to Live in Florida Get as much as $100,000 with rates starting at 5.95% APR*, Use a personal loan to pay off debt, renovate your home, family needs, and more, Takes minutes to see how much you can get. Median Home Value: $264,421 Mississippi homeowners will pay property taxes at a rate of 0.81% per year, setting them back $1,278 annually.  At UpNest home buyers can also get a cash rebate to use towards purchasing and decorating their new affordable dream homes. Large industries like transportation, aerospace, financial services, and manufacturing are leading the states economy. Published 31 July 22, Reds and purples may be regal but they're better left beyond the bedroom. But most homebuyers don't work out the numbers fully and only realize they've become house poor when it's too late. 'They are growing in popularity as residents can get more space and access good schools.'. Square Footage and More, 5 Cheapest Places to Live in New York City. Median Home Value: $277,801 Median Home Value: $177,300 West Virginia still boasts many unspoiled miles of nature and majestic mountain views. Home to more than 10.4 million people, North Carolina, is the 9th largest state by population in the U.S. The title of the most expensive or least affordable state to buy a house goes with Hawaii.

At UpNest home buyers can also get a cash rebate to use towards purchasing and decorating their new affordable dream homes. Large industries like transportation, aerospace, financial services, and manufacturing are leading the states economy. Published 31 July 22, Reds and purples may be regal but they're better left beyond the bedroom. But most homebuyers don't work out the numbers fully and only realize they've become house poor when it's too late. 'They are growing in popularity as residents can get more space and access good schools.'. Square Footage and More, 5 Cheapest Places to Live in New York City. Median Home Value: $277,801 Median Home Value: $177,300 West Virginia still boasts many unspoiled miles of nature and majestic mountain views. Home to more than 10.4 million people, North Carolina, is the 9th largest state by population in the U.S. The title of the most expensive or least affordable state to buy a house goes with Hawaii.  The state also boasts a low annual property tax of $895, well below the national average of $2,471. People looking to buy a home in the current hot market are now looking elsewhere to deploy that money. Average rent: $1,028. Minot, Fargo, Grand Forks, and Jamestown are affordable cities to buy a house. As for the annual property tax, you can expect to pay over $1,100.

The state also boasts a low annual property tax of $895, well below the national average of $2,471. People looking to buy a home in the current hot market are now looking elsewhere to deploy that money. Average rent: $1,028. Minot, Fargo, Grand Forks, and Jamestown are affordable cities to buy a house. As for the annual property tax, you can expect to pay over $1,100.  Kansas's effective state property tax rate is 1.41%, resulting in annual taxes of about $2,795 in taxes per year for homeowners. House poor is someone who spends a large portion of their income on homeownership, leaving little for other necessary expenses. Raleigh in North Carolina has been attracting homebuyers in huge numbers since 2020 thanks to the low cost of living and job opportunities. According to Zillow, the median home value is a whopping $850,000, making it the priciest state for home ownership. Oklahoma homeowners pay a property tax rate of 0.90%, resulting in about $1,540 in taxes per year based on the typical home value. Mississippi is the second-cheapest state to buy a home in, with a typical home valued at $157,828. Even if you do end up owning a home, insurance costs and property taxes may force you to second-guess your decision. Median Home Value: $218,50 As noted, you also have to factor mortgage payments and insurance costs into your calculations. Fortunately, the cheapest states to buy a house in also double as states with a lot of space. The ordinary home in Oregon costs you more than $312,005. Buying real estate, and a home specifically, is the American dream. Median Home Value: $200,100 Average rent: $1,160. Harrisburg is the states capital city, while Philadelphia/Delaware Valley is the central metropolitan area of the state and home to the majority of the states population. ', 'It is a no-brainer as far as investment and return,' he adds. Frankfort is the states capital, and Louisville is Kentuckys central metropolitan area.

Kansas's effective state property tax rate is 1.41%, resulting in annual taxes of about $2,795 in taxes per year for homeowners. House poor is someone who spends a large portion of their income on homeownership, leaving little for other necessary expenses. Raleigh in North Carolina has been attracting homebuyers in huge numbers since 2020 thanks to the low cost of living and job opportunities. According to Zillow, the median home value is a whopping $850,000, making it the priciest state for home ownership. Oklahoma homeowners pay a property tax rate of 0.90%, resulting in about $1,540 in taxes per year based on the typical home value. Mississippi is the second-cheapest state to buy a home in, with a typical home valued at $157,828. Even if you do end up owning a home, insurance costs and property taxes may force you to second-guess your decision. Median Home Value: $218,50 As noted, you also have to factor mortgage payments and insurance costs into your calculations. Fortunately, the cheapest states to buy a house in also double as states with a lot of space. The ordinary home in Oregon costs you more than $312,005. Buying real estate, and a home specifically, is the American dream. Median Home Value: $200,100 Average rent: $1,160. Harrisburg is the states capital city, while Philadelphia/Delaware Valley is the central metropolitan area of the state and home to the majority of the states population. ', 'It is a no-brainer as far as investment and return,' he adds. Frankfort is the states capital, and Louisville is Kentuckys central metropolitan area.  There are various reasons like rapidly increasing population, supply shortages, increasing demand, or all of these. Affording a house here costs 21% of their median income (93,000). Kansass economy relies on its agriculture, manufacturing, and natural resources. Average rent: $1,150. Late fall through winter tends to showcase less housing inventory, while spring and early summer tend to have the highest home prices. Cody Tromler is the Content Marketing Manager for UpNest.com. The median household income is over $53,000, and home prices in the state have grown an average of 17.63%. Portland is the largest metropolitan area, and Salem is the 2nd largest city by population and the state capital.

There are various reasons like rapidly increasing population, supply shortages, increasing demand, or all of these. Affording a house here costs 21% of their median income (93,000). Kansass economy relies on its agriculture, manufacturing, and natural resources. Average rent: $1,150. Late fall through winter tends to showcase less housing inventory, while spring and early summer tend to have the highest home prices. Cody Tromler is the Content Marketing Manager for UpNest.com. The median household income is over $53,000, and home prices in the state have grown an average of 17.63%. Portland is the largest metropolitan area, and Salem is the 2nd largest city by population and the state capital.  Home prices have grown 20.01%, and the state's median household income is about $80,000. Median Home Value: 271,211 Median Home Value: $122,342 If your finances don't allow you to buy a home, the financial adviser can even work out strategies that'll put you on the path to homeownership. West Virginia also has the nation's highest homeownership rate, with 79.6% of its residents owning their homes. 'Tampas home values are projected to grow 24.6% this year, a strong forecasted growth that helped land it at the top of this list. Greenville Anderson is the largest city in the state, with a population of 150,277 as of 2020. OH may be one of the most underrated states in America. Average Rent: $980. Oklahoma's homeownership rate is 67.3%. Bay City, Saginaw, Detroit, and Flint are the most affordable cities to buy a house in Michigan. West Virginia is one of the cheapest real estate states and the 40th most populated state in the U.S. with a population of less than 1.8 million. The cheapest cities to buy a house in Tennessee are Jackson, Johnson City, Kingsport, and Memphis. Any budgeting you did before owning a home doesn't apply now. The cheapest cities of the state are Wichita Falls, Pharr, Brownsville, and Port Arthur. However, any expressed opinions are our own and aren't influenced by compensation. Households in the state have a median income of over $61,000, and the annual property tax is slightly more than $3,000. Zillow insists that a combination of factors will make Tampa in Florida one of the most desirable US cities for buyers. The cheapest cities are Fayetteville, Burlington, Wilson, and Rocky Mount, where you can afford an appropriate house. If all of your daily and monthly expenses are 4x more or less, it is going to make a huge difference in how much or little you have left after the bills are paid, and what you can afford to do for fun. Another Midwestern state, Missouri ranks 19th in population size with over 6.1 million people. Hawaii is the 11th least populous state in the U.S, with 1.4 million people. Alabama has the second-lowest state property tax rate of 0.42%.

Home prices have grown 20.01%, and the state's median household income is about $80,000. Median Home Value: 271,211 Median Home Value: $122,342 If your finances don't allow you to buy a home, the financial adviser can even work out strategies that'll put you on the path to homeownership. West Virginia also has the nation's highest homeownership rate, with 79.6% of its residents owning their homes. 'Tampas home values are projected to grow 24.6% this year, a strong forecasted growth that helped land it at the top of this list. Greenville Anderson is the largest city in the state, with a population of 150,277 as of 2020. OH may be one of the most underrated states in America. Average Rent: $980. Oklahoma's homeownership rate is 67.3%. Bay City, Saginaw, Detroit, and Flint are the most affordable cities to buy a house in Michigan. West Virginia is one of the cheapest real estate states and the 40th most populated state in the U.S. with a population of less than 1.8 million. The cheapest cities to buy a house in Tennessee are Jackson, Johnson City, Kingsport, and Memphis. Any budgeting you did before owning a home doesn't apply now. The cheapest cities of the state are Wichita Falls, Pharr, Brownsville, and Port Arthur. However, any expressed opinions are our own and aren't influenced by compensation. Households in the state have a median income of over $61,000, and the annual property tax is slightly more than $3,000. Zillow insists that a combination of factors will make Tampa in Florida one of the most desirable US cities for buyers. The cheapest cities are Fayetteville, Burlington, Wilson, and Rocky Mount, where you can afford an appropriate house. If all of your daily and monthly expenses are 4x more or less, it is going to make a huge difference in how much or little you have left after the bills are paid, and what you can afford to do for fun. Another Midwestern state, Missouri ranks 19th in population size with over 6.1 million people. Hawaii is the 11th least populous state in the U.S, with 1.4 million people. Alabama has the second-lowest state property tax rate of 0.42%.  Idaho, Indiana, Utah, and New Hampshire filled out the top five in those rankings. Homeownership in the state sits at 71.5%. Hawaii is among the worst states for homeowners. Fargo is the most urban city, and Bismarck is the states capital. Zillow has revealed the surprising location to be named one of the best places to buy a house in the US in 2022.

Idaho, Indiana, Utah, and New Hampshire filled out the top five in those rankings. Homeownership in the state sits at 71.5%. Hawaii is among the worst states for homeowners. Fargo is the most urban city, and Bismarck is the states capital. Zillow has revealed the surprising location to be named one of the best places to buy a house in the US in 2022.  With a population of almost 7 million people, Southeastern state Tennessee ranks 16th most populous state in the U.S. and makes it in the list of cheapest places to buy a house in 2022. Additionally, a thriving job market, relatively scarce and fast-moving inventory, year-round sunny weather, and demographics that indicate a good number of potential buyers all contributed to Tampa taking the number one spot.'. Service sectors like retail, finance, healthcare, and agriculture lead the economy of South Dakota.

With a population of almost 7 million people, Southeastern state Tennessee ranks 16th most populous state in the U.S. and makes it in the list of cheapest places to buy a house in 2022. Additionally, a thriving job market, relatively scarce and fast-moving inventory, year-round sunny weather, and demographics that indicate a good number of potential buyers all contributed to Tampa taking the number one spot.'. Service sectors like retail, finance, healthcare, and agriculture lead the economy of South Dakota.  However, amid recent economic data and fears of a looming recession, prices have eased a little from their high. However, if the City isn't for you, just under 2 hours from Raleigh is Little Washington one of the best places to buy a beach house in North Carolina. These states have shocking home costs, more than bearable.

However, amid recent economic data and fears of a looming recession, prices have eased a little from their high. However, if the City isn't for you, just under 2 hours from Raleigh is Little Washington one of the best places to buy a beach house in North Carolina. These states have shocking home costs, more than bearable.  Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. With a homeownership rate of 66.5%, the state has a slightly homeownership rate than the country as a whole.

Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. With a homeownership rate of 66.5%, the state has a slightly homeownership rate than the country as a whole.  'We have a somewhat competitive market that is not ballooning home prices nor is coming at below-asking prices. Mississippi is another one of the cheapest states to buy a house. Median Home Value: $151,190 Median Home Value: $252,299 First Time Buying a House? After graduating she started out as a feature writer for Women's Weekly magazines, before shifting over to online journalism and joining the Ideal Home digital team covering news and features. Manitowoc, Racine, Beloit, and Fond du Lac are the cities with affordable home prices in the Wisconsin state.

'We have a somewhat competitive market that is not ballooning home prices nor is coming at below-asking prices. Mississippi is another one of the cheapest states to buy a house. Median Home Value: $151,190 Median Home Value: $252,299 First Time Buying a House? After graduating she started out as a feature writer for Women's Weekly magazines, before shifting over to online journalism and joining the Ideal Home digital team covering news and features. Manitowoc, Racine, Beloit, and Fond du Lac are the cities with affordable home prices in the Wisconsin state.  Average rent: $1,058. However, only 65.4% of U.S. households currently own their home. Alongside Tampa, here are the four other locations predicted to have the hottest housing markets in the US in 2022.

Average rent: $1,058. However, only 65.4% of U.S. households currently own their home. Alongside Tampa, here are the four other locations predicted to have the hottest housing markets in the US in 2022.  Harrisburg, Altoona, Wilkes-Barre, and Scranton are the cities where you can buy an affordable house. The average price of an 8,000 square foot mansion was $504,000. Agriculture, manufacturing and the healthcare and financial sectors help keep the economy of Alabama prosperous. Average Rent: $912.

Harrisburg, Altoona, Wilkes-Barre, and Scranton are the cities where you can buy an affordable house. The average price of an 8,000 square foot mansion was $504,000. Agriculture, manufacturing and the healthcare and financial sectors help keep the economy of Alabama prosperous. Average Rent: $912.  Another Midwestern state on the list is Indiana, the 17th most populated state in the U.S. (its population is just above 6.1 million). The annual property tax, however, is on the high side at 3,407, well above the national average. The unemployment is 4.3%. Texass capital Austin is the second most populous capital in the U.S. At the same time, Texass most significant metropolitan area is Dallas-Fort Worth, the fourth largest metro area in the country. So, do your home and see how much down payment you'll need. Average Rent: $991. However, Tampa is expected to soar past this with home values growing 24.6 percent during that time. The second-largest state of the U.S, both by area and population, Texas has a home of more than 29.1 million people. Both cities have a higher cost of living compared to other cities in the state. Thus, many may find themselves priced out of homeownership. Its worth noting that the national average home price rose from $246,000 in January 2020 to $269,000 a year later in January of 2021 according to Zillow. It charges one of the highest annual property taxes at about $5,500, and Zillow pegs the median home value at over $440,000.

Another Midwestern state on the list is Indiana, the 17th most populated state in the U.S. (its population is just above 6.1 million). The annual property tax, however, is on the high side at 3,407, well above the national average. The unemployment is 4.3%. Texass capital Austin is the second most populous capital in the U.S. At the same time, Texass most significant metropolitan area is Dallas-Fort Worth, the fourth largest metro area in the country. So, do your home and see how much down payment you'll need. Average Rent: $991. However, Tampa is expected to soar past this with home values growing 24.6 percent during that time. The second-largest state of the U.S, both by area and population, Texas has a home of more than 29.1 million people. Both cities have a higher cost of living compared to other cities in the state. Thus, many may find themselves priced out of homeownership. Its worth noting that the national average home price rose from $246,000 in January 2020 to $269,000 a year later in January of 2021 according to Zillow. It charges one of the highest annual property taxes at about $5,500, and Zillow pegs the median home value at over $440,000.  'Homes that are priced well are drawing multiple bids due to tight inventory and steadily increasing value prices,' explains Gordon von Broock, Douglas Elliman (opens in new tab) agent. Agriculture, manufacturing, natural resources sectors, information technology, and biotechnology drive Iowas diverse economy. There is a significant difference in the home costs of these states and the conditions mentioned above. Milwaukee is the largest city and metro area of the state, though the states capital is Madison. NY, NJ, and CT are notorious for their extremely high property taxes. St. Joseph, Joplin, Florissant, and Independence are the cities with the most inexpensive houses in the state. In general, West Virginia is one of the cheapest states to live in. We have done some research and identified some of the most affordable real estate states in the USA. Here's What to Expect, How to Find Your Dream Home: A Step-by-Step Guide, 15 Things You Need to Know Before Buying a Home, Find a Personal Loan Even if You Have Bad Credit. North Central U.S state South Dakota is the 4th least populous state with just 890,000. Fewer people live in the entire state than in the city of Miami. There are a variety of factors that dictate the cheapest states to buy a house and the cheapest states to live in. Job opportunities, amenities, crime rates are all important areas to investigate before moving to a new home.

'Homes that are priced well are drawing multiple bids due to tight inventory and steadily increasing value prices,' explains Gordon von Broock, Douglas Elliman (opens in new tab) agent. Agriculture, manufacturing, natural resources sectors, information technology, and biotechnology drive Iowas diverse economy. There is a significant difference in the home costs of these states and the conditions mentioned above. Milwaukee is the largest city and metro area of the state, though the states capital is Madison. NY, NJ, and CT are notorious for their extremely high property taxes. St. Joseph, Joplin, Florissant, and Independence are the cities with the most inexpensive houses in the state. In general, West Virginia is one of the cheapest states to live in. We have done some research and identified some of the most affordable real estate states in the USA. Here's What to Expect, How to Find Your Dream Home: A Step-by-Step Guide, 15 Things You Need to Know Before Buying a Home, Find a Personal Loan Even if You Have Bad Credit. North Central U.S state South Dakota is the 4th least populous state with just 890,000. Fewer people live in the entire state than in the city of Miami. There are a variety of factors that dictate the cheapest states to buy a house and the cheapest states to live in. Job opportunities, amenities, crime rates are all important areas to investigate before moving to a new home.  Average rent: $1,138. These costs should be taken into your account in your new budget. Building regulations and the cost of building permits can make it more or less expensive to buy a brand new home or build your own custom home.

Average rent: $1,138. These costs should be taken into your account in your new budget. Building regulations and the cost of building permits can make it more or less expensive to buy a brand new home or build your own custom home.  If your state is prone to frequent hurricanes, wildfires, and tornadoes, expect to pay, Its also worth calculating the local cost of living before you move. 'Charlotte is seeing more demand than most cities in the Southeast - median prices up 22% year-over-year - and at a higher price point, up to $450K in many suburbs. ', 'My favorite places to look at in the area are Sawgrass and Fleming Island.'. North Dakota is the 3rd smallest state by population, having a home to just 780,000 people. The typical home in Louisiana costs $205,972. Thats why finding a cheap state to buy a house in is not that easy. With personal interest rates near record lows, It takes minutes to see how much you could get. With a relatively high property tax rate of 1.56%, homeowners can expect to pay $2,861 in property taxes each year. Seattle is the most significant metropolitan area. The Zillow Home Value Index, which measures only the middle price tiers of homes, sets the cost of a typical home in the United States at $344,141. See the online provider's application for details about terms and conditions. The best cities to buy an affordable house are Warren, Marion, Youngstown, and Dayton. By Antonia Santoro Now that technology has made it possible to live and invest in real estate anywhere there is an internet connection, and we can work from almost anywhere on the planet, expect the cheapest states to buy a house to start trending. Reasonable efforts have been made by Credit Sesame to maintain accurate information, however, all information is presented without warranty or guarantee. Los Angeles and other major cities of California are San Diego, San Francisco, and Sacramento, which is also the state capital. Hawaiis island state is in priority for vacationers as it is famous for its aesthetic beaches and pleasant weather. From music to nature there are lots to love about living in KY. Theres a lot to love about Kansas if you dont mind a few tornadoes. 'Were continuing to see lots of young professionals and families move to North Carolina,' says Jon Enberg, Charlotte General Manager at Opendoor (opens in new tab). It seems this content shouldbe in a separate article. Best Places To Live In NJ Close To NYC In 2022 Sign up for Credit Sesame and find options up to $100K Starting at 5.99% APR through Credit Sesame's lending partners, Home ownership is everyone's dream. Alabama's median home price is $194,695. The unemployment rate is also on the high side at 4.4%. According to Zillow, the median home value is over $760,000, and the annual property tax is $1,644. 'Raleigh, North Carolina will give your property sustained appreciation. Make sure you read the policy thoroughly before signing, and if something doesn't make sense, you should ask questions. Kentucky is the sixth-cheapest state to buy a home in, with a typical home valued at $188,439. Lansing is the state capital, and Detroit is Michigans metro area and the cheapest city. Here are the 10 states with the lowest typical house value: West Virginia is the cheapest state to buy a home. But in the current economic conditions, it will remain just that for several people a dream. A variety of laws can impact how much money you have left to spend on housing each month, and how safe the money you invest in your house is. Omaha Bluffs is the states largest metropolitan city and the state capital is Des Moines. Median Home Value: $191,101

If your state is prone to frequent hurricanes, wildfires, and tornadoes, expect to pay, Its also worth calculating the local cost of living before you move. 'Charlotte is seeing more demand than most cities in the Southeast - median prices up 22% year-over-year - and at a higher price point, up to $450K in many suburbs. ', 'My favorite places to look at in the area are Sawgrass and Fleming Island.'. North Dakota is the 3rd smallest state by population, having a home to just 780,000 people. The typical home in Louisiana costs $205,972. Thats why finding a cheap state to buy a house in is not that easy. With personal interest rates near record lows, It takes minutes to see how much you could get. With a relatively high property tax rate of 1.56%, homeowners can expect to pay $2,861 in property taxes each year. Seattle is the most significant metropolitan area. The Zillow Home Value Index, which measures only the middle price tiers of homes, sets the cost of a typical home in the United States at $344,141. See the online provider's application for details about terms and conditions. The best cities to buy an affordable house are Warren, Marion, Youngstown, and Dayton. By Antonia Santoro Now that technology has made it possible to live and invest in real estate anywhere there is an internet connection, and we can work from almost anywhere on the planet, expect the cheapest states to buy a house to start trending. Reasonable efforts have been made by Credit Sesame to maintain accurate information, however, all information is presented without warranty or guarantee. Los Angeles and other major cities of California are San Diego, San Francisco, and Sacramento, which is also the state capital. Hawaiis island state is in priority for vacationers as it is famous for its aesthetic beaches and pleasant weather. From music to nature there are lots to love about living in KY. Theres a lot to love about Kansas if you dont mind a few tornadoes. 'Were continuing to see lots of young professionals and families move to North Carolina,' says Jon Enberg, Charlotte General Manager at Opendoor (opens in new tab). It seems this content shouldbe in a separate article. Best Places To Live In NJ Close To NYC In 2022 Sign up for Credit Sesame and find options up to $100K Starting at 5.99% APR through Credit Sesame's lending partners, Home ownership is everyone's dream. Alabama's median home price is $194,695. The unemployment rate is also on the high side at 4.4%. According to Zillow, the median home value is over $760,000, and the annual property tax is $1,644. 'Raleigh, North Carolina will give your property sustained appreciation. Make sure you read the policy thoroughly before signing, and if something doesn't make sense, you should ask questions. Kentucky is the sixth-cheapest state to buy a home in, with a typical home valued at $188,439. Lansing is the state capital, and Detroit is Michigans metro area and the cheapest city. Here are the 10 states with the lowest typical house value: West Virginia is the cheapest state to buy a home. But in the current economic conditions, it will remain just that for several people a dream. A variety of laws can impact how much money you have left to spend on housing each month, and how safe the money you invest in your house is. Omaha Bluffs is the states largest metropolitan city and the state capital is Des Moines. Median Home Value: $191,101  Arkansas is the 33rd largest state in the U.S. with more than 3 million people as of 2018. Atlanta is, at the same time, the capital and largest metropolitan area of the state. New Yorkers have a median household income of over $71,000, and home prices in the Empire State have increased 14.36%. Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. Kansas City, Salina, and Hutchinson are the cheapest cities to buy houses in Kansas. It is the 13th most populous state with over 7.7 million. Median Home Value: $184,021 When you purchase through links on our site, we may earn an affiliate commission. Average rent: $1,115. Get a Personal Loan Even If You Have Bad Credit. Buying a home is the most significant financial decision most people will make in their lifetime.

Arkansas is the 33rd largest state in the U.S. with more than 3 million people as of 2018. Atlanta is, at the same time, the capital and largest metropolitan area of the state. New Yorkers have a median household income of over $71,000, and home prices in the Empire State have increased 14.36%. Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. Kansas City, Salina, and Hutchinson are the cheapest cities to buy houses in Kansas. It is the 13th most populous state with over 7.7 million. Median Home Value: $184,021 When you purchase through links on our site, we may earn an affiliate commission. Average rent: $1,115. Get a Personal Loan Even If You Have Bad Credit. Buying a home is the most significant financial decision most people will make in their lifetime.

At UpNest home buyers can also get a cash rebate to use towards purchasing and decorating their new affordable dream homes. Large industries like transportation, aerospace, financial services, and manufacturing are leading the states economy. Published 31 July 22, Reds and purples may be regal but they're better left beyond the bedroom. But most homebuyers don't work out the numbers fully and only realize they've become house poor when it's too late. 'They are growing in popularity as residents can get more space and access good schools.'. Square Footage and More, 5 Cheapest Places to Live in New York City. Median Home Value: $277,801 Median Home Value: $177,300 West Virginia still boasts many unspoiled miles of nature and majestic mountain views. Home to more than 10.4 million people, North Carolina, is the 9th largest state by population in the U.S. The title of the most expensive or least affordable state to buy a house goes with Hawaii.

At UpNest home buyers can also get a cash rebate to use towards purchasing and decorating their new affordable dream homes. Large industries like transportation, aerospace, financial services, and manufacturing are leading the states economy. Published 31 July 22, Reds and purples may be regal but they're better left beyond the bedroom. But most homebuyers don't work out the numbers fully and only realize they've become house poor when it's too late. 'They are growing in popularity as residents can get more space and access good schools.'. Square Footage and More, 5 Cheapest Places to Live in New York City. Median Home Value: $277,801 Median Home Value: $177,300 West Virginia still boasts many unspoiled miles of nature and majestic mountain views. Home to more than 10.4 million people, North Carolina, is the 9th largest state by population in the U.S. The title of the most expensive or least affordable state to buy a house goes with Hawaii.  The state also boasts a low annual property tax of $895, well below the national average of $2,471. People looking to buy a home in the current hot market are now looking elsewhere to deploy that money. Average rent: $1,028. Minot, Fargo, Grand Forks, and Jamestown are affordable cities to buy a house. As for the annual property tax, you can expect to pay over $1,100.

The state also boasts a low annual property tax of $895, well below the national average of $2,471. People looking to buy a home in the current hot market are now looking elsewhere to deploy that money. Average rent: $1,028. Minot, Fargo, Grand Forks, and Jamestown are affordable cities to buy a house. As for the annual property tax, you can expect to pay over $1,100.  Kansas's effective state property tax rate is 1.41%, resulting in annual taxes of about $2,795 in taxes per year for homeowners. House poor is someone who spends a large portion of their income on homeownership, leaving little for other necessary expenses. Raleigh in North Carolina has been attracting homebuyers in huge numbers since 2020 thanks to the low cost of living and job opportunities. According to Zillow, the median home value is a whopping $850,000, making it the priciest state for home ownership. Oklahoma homeowners pay a property tax rate of 0.90%, resulting in about $1,540 in taxes per year based on the typical home value. Mississippi is the second-cheapest state to buy a home in, with a typical home valued at $157,828. Even if you do end up owning a home, insurance costs and property taxes may force you to second-guess your decision. Median Home Value: $218,50 As noted, you also have to factor mortgage payments and insurance costs into your calculations. Fortunately, the cheapest states to buy a house in also double as states with a lot of space. The ordinary home in Oregon costs you more than $312,005. Buying real estate, and a home specifically, is the American dream. Median Home Value: $200,100 Average rent: $1,160. Harrisburg is the states capital city, while Philadelphia/Delaware Valley is the central metropolitan area of the state and home to the majority of the states population. ', 'It is a no-brainer as far as investment and return,' he adds. Frankfort is the states capital, and Louisville is Kentuckys central metropolitan area.

Kansas's effective state property tax rate is 1.41%, resulting in annual taxes of about $2,795 in taxes per year for homeowners. House poor is someone who spends a large portion of their income on homeownership, leaving little for other necessary expenses. Raleigh in North Carolina has been attracting homebuyers in huge numbers since 2020 thanks to the low cost of living and job opportunities. According to Zillow, the median home value is a whopping $850,000, making it the priciest state for home ownership. Oklahoma homeowners pay a property tax rate of 0.90%, resulting in about $1,540 in taxes per year based on the typical home value. Mississippi is the second-cheapest state to buy a home in, with a typical home valued at $157,828. Even if you do end up owning a home, insurance costs and property taxes may force you to second-guess your decision. Median Home Value: $218,50 As noted, you also have to factor mortgage payments and insurance costs into your calculations. Fortunately, the cheapest states to buy a house in also double as states with a lot of space. The ordinary home in Oregon costs you more than $312,005. Buying real estate, and a home specifically, is the American dream. Median Home Value: $200,100 Average rent: $1,160. Harrisburg is the states capital city, while Philadelphia/Delaware Valley is the central metropolitan area of the state and home to the majority of the states population. ', 'It is a no-brainer as far as investment and return,' he adds. Frankfort is the states capital, and Louisville is Kentuckys central metropolitan area.  There are various reasons like rapidly increasing population, supply shortages, increasing demand, or all of these. Affording a house here costs 21% of their median income (93,000). Kansass economy relies on its agriculture, manufacturing, and natural resources. Average rent: $1,150. Late fall through winter tends to showcase less housing inventory, while spring and early summer tend to have the highest home prices. Cody Tromler is the Content Marketing Manager for UpNest.com. The median household income is over $53,000, and home prices in the state have grown an average of 17.63%. Portland is the largest metropolitan area, and Salem is the 2nd largest city by population and the state capital.

There are various reasons like rapidly increasing population, supply shortages, increasing demand, or all of these. Affording a house here costs 21% of their median income (93,000). Kansass economy relies on its agriculture, manufacturing, and natural resources. Average rent: $1,150. Late fall through winter tends to showcase less housing inventory, while spring and early summer tend to have the highest home prices. Cody Tromler is the Content Marketing Manager for UpNest.com. The median household income is over $53,000, and home prices in the state have grown an average of 17.63%. Portland is the largest metropolitan area, and Salem is the 2nd largest city by population and the state capital.  Home prices have grown 20.01%, and the state's median household income is about $80,000. Median Home Value: 271,211 Median Home Value: $122,342 If your finances don't allow you to buy a home, the financial adviser can even work out strategies that'll put you on the path to homeownership. West Virginia also has the nation's highest homeownership rate, with 79.6% of its residents owning their homes. 'Tampas home values are projected to grow 24.6% this year, a strong forecasted growth that helped land it at the top of this list. Greenville Anderson is the largest city in the state, with a population of 150,277 as of 2020. OH may be one of the most underrated states in America. Average Rent: $980. Oklahoma's homeownership rate is 67.3%. Bay City, Saginaw, Detroit, and Flint are the most affordable cities to buy a house in Michigan. West Virginia is one of the cheapest real estate states and the 40th most populated state in the U.S. with a population of less than 1.8 million. The cheapest cities to buy a house in Tennessee are Jackson, Johnson City, Kingsport, and Memphis. Any budgeting you did before owning a home doesn't apply now. The cheapest cities of the state are Wichita Falls, Pharr, Brownsville, and Port Arthur. However, any expressed opinions are our own and aren't influenced by compensation. Households in the state have a median income of over $61,000, and the annual property tax is slightly more than $3,000. Zillow insists that a combination of factors will make Tampa in Florida one of the most desirable US cities for buyers. The cheapest cities are Fayetteville, Burlington, Wilson, and Rocky Mount, where you can afford an appropriate house. If all of your daily and monthly expenses are 4x more or less, it is going to make a huge difference in how much or little you have left after the bills are paid, and what you can afford to do for fun. Another Midwestern state, Missouri ranks 19th in population size with over 6.1 million people. Hawaii is the 11th least populous state in the U.S, with 1.4 million people. Alabama has the second-lowest state property tax rate of 0.42%.

Home prices have grown 20.01%, and the state's median household income is about $80,000. Median Home Value: 271,211 Median Home Value: $122,342 If your finances don't allow you to buy a home, the financial adviser can even work out strategies that'll put you on the path to homeownership. West Virginia also has the nation's highest homeownership rate, with 79.6% of its residents owning their homes. 'Tampas home values are projected to grow 24.6% this year, a strong forecasted growth that helped land it at the top of this list. Greenville Anderson is the largest city in the state, with a population of 150,277 as of 2020. OH may be one of the most underrated states in America. Average Rent: $980. Oklahoma's homeownership rate is 67.3%. Bay City, Saginaw, Detroit, and Flint are the most affordable cities to buy a house in Michigan. West Virginia is one of the cheapest real estate states and the 40th most populated state in the U.S. with a population of less than 1.8 million. The cheapest cities to buy a house in Tennessee are Jackson, Johnson City, Kingsport, and Memphis. Any budgeting you did before owning a home doesn't apply now. The cheapest cities of the state are Wichita Falls, Pharr, Brownsville, and Port Arthur. However, any expressed opinions are our own and aren't influenced by compensation. Households in the state have a median income of over $61,000, and the annual property tax is slightly more than $3,000. Zillow insists that a combination of factors will make Tampa in Florida one of the most desirable US cities for buyers. The cheapest cities are Fayetteville, Burlington, Wilson, and Rocky Mount, where you can afford an appropriate house. If all of your daily and monthly expenses are 4x more or less, it is going to make a huge difference in how much or little you have left after the bills are paid, and what you can afford to do for fun. Another Midwestern state, Missouri ranks 19th in population size with over 6.1 million people. Hawaii is the 11th least populous state in the U.S, with 1.4 million people. Alabama has the second-lowest state property tax rate of 0.42%.  Idaho, Indiana, Utah, and New Hampshire filled out the top five in those rankings. Homeownership in the state sits at 71.5%. Hawaii is among the worst states for homeowners. Fargo is the most urban city, and Bismarck is the states capital. Zillow has revealed the surprising location to be named one of the best places to buy a house in the US in 2022.

Idaho, Indiana, Utah, and New Hampshire filled out the top five in those rankings. Homeownership in the state sits at 71.5%. Hawaii is among the worst states for homeowners. Fargo is the most urban city, and Bismarck is the states capital. Zillow has revealed the surprising location to be named one of the best places to buy a house in the US in 2022.  With a population of almost 7 million people, Southeastern state Tennessee ranks 16th most populous state in the U.S. and makes it in the list of cheapest places to buy a house in 2022. Additionally, a thriving job market, relatively scarce and fast-moving inventory, year-round sunny weather, and demographics that indicate a good number of potential buyers all contributed to Tampa taking the number one spot.'. Service sectors like retail, finance, healthcare, and agriculture lead the economy of South Dakota.

With a population of almost 7 million people, Southeastern state Tennessee ranks 16th most populous state in the U.S. and makes it in the list of cheapest places to buy a house in 2022. Additionally, a thriving job market, relatively scarce and fast-moving inventory, year-round sunny weather, and demographics that indicate a good number of potential buyers all contributed to Tampa taking the number one spot.'. Service sectors like retail, finance, healthcare, and agriculture lead the economy of South Dakota.  However, amid recent economic data and fears of a looming recession, prices have eased a little from their high. However, if the City isn't for you, just under 2 hours from Raleigh is Little Washington one of the best places to buy a beach house in North Carolina. These states have shocking home costs, more than bearable.

However, amid recent economic data and fears of a looming recession, prices have eased a little from their high. However, if the City isn't for you, just under 2 hours from Raleigh is Little Washington one of the best places to buy a beach house in North Carolina. These states have shocking home costs, more than bearable.  Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. With a homeownership rate of 66.5%, the state has a slightly homeownership rate than the country as a whole.

Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. With a homeownership rate of 66.5%, the state has a slightly homeownership rate than the country as a whole.  'We have a somewhat competitive market that is not ballooning home prices nor is coming at below-asking prices. Mississippi is another one of the cheapest states to buy a house. Median Home Value: $151,190 Median Home Value: $252,299 First Time Buying a House? After graduating she started out as a feature writer for Women's Weekly magazines, before shifting over to online journalism and joining the Ideal Home digital team covering news and features. Manitowoc, Racine, Beloit, and Fond du Lac are the cities with affordable home prices in the Wisconsin state.

'We have a somewhat competitive market that is not ballooning home prices nor is coming at below-asking prices. Mississippi is another one of the cheapest states to buy a house. Median Home Value: $151,190 Median Home Value: $252,299 First Time Buying a House? After graduating she started out as a feature writer for Women's Weekly magazines, before shifting over to online journalism and joining the Ideal Home digital team covering news and features. Manitowoc, Racine, Beloit, and Fond du Lac are the cities with affordable home prices in the Wisconsin state.  Average rent: $1,058. However, only 65.4% of U.S. households currently own their home. Alongside Tampa, here are the four other locations predicted to have the hottest housing markets in the US in 2022.

Average rent: $1,058. However, only 65.4% of U.S. households currently own their home. Alongside Tampa, here are the four other locations predicted to have the hottest housing markets in the US in 2022.  Another Midwestern state on the list is Indiana, the 17th most populated state in the U.S. (its population is just above 6.1 million). The annual property tax, however, is on the high side at 3,407, well above the national average. The unemployment is 4.3%. Texass capital Austin is the second most populous capital in the U.S. At the same time, Texass most significant metropolitan area is Dallas-Fort Worth, the fourth largest metro area in the country. So, do your home and see how much down payment you'll need. Average Rent: $991. However, Tampa is expected to soar past this with home values growing 24.6 percent during that time. The second-largest state of the U.S, both by area and population, Texas has a home of more than 29.1 million people. Both cities have a higher cost of living compared to other cities in the state. Thus, many may find themselves priced out of homeownership. Its worth noting that the national average home price rose from $246,000 in January 2020 to $269,000 a year later in January of 2021 according to Zillow. It charges one of the highest annual property taxes at about $5,500, and Zillow pegs the median home value at over $440,000.

Another Midwestern state on the list is Indiana, the 17th most populated state in the U.S. (its population is just above 6.1 million). The annual property tax, however, is on the high side at 3,407, well above the national average. The unemployment is 4.3%. Texass capital Austin is the second most populous capital in the U.S. At the same time, Texass most significant metropolitan area is Dallas-Fort Worth, the fourth largest metro area in the country. So, do your home and see how much down payment you'll need. Average Rent: $991. However, Tampa is expected to soar past this with home values growing 24.6 percent during that time. The second-largest state of the U.S, both by area and population, Texas has a home of more than 29.1 million people. Both cities have a higher cost of living compared to other cities in the state. Thus, many may find themselves priced out of homeownership. Its worth noting that the national average home price rose from $246,000 in January 2020 to $269,000 a year later in January of 2021 according to Zillow. It charges one of the highest annual property taxes at about $5,500, and Zillow pegs the median home value at over $440,000.  'Homes that are priced well are drawing multiple bids due to tight inventory and steadily increasing value prices,' explains Gordon von Broock, Douglas Elliman (opens in new tab) agent. Agriculture, manufacturing, natural resources sectors, information technology, and biotechnology drive Iowas diverse economy. There is a significant difference in the home costs of these states and the conditions mentioned above. Milwaukee is the largest city and metro area of the state, though the states capital is Madison. NY, NJ, and CT are notorious for their extremely high property taxes. St. Joseph, Joplin, Florissant, and Independence are the cities with the most inexpensive houses in the state. In general, West Virginia is one of the cheapest states to live in. We have done some research and identified some of the most affordable real estate states in the USA. Here's What to Expect, How to Find Your Dream Home: A Step-by-Step Guide, 15 Things You Need to Know Before Buying a Home, Find a Personal Loan Even if You Have Bad Credit. North Central U.S state South Dakota is the 4th least populous state with just 890,000. Fewer people live in the entire state than in the city of Miami. There are a variety of factors that dictate the cheapest states to buy a house and the cheapest states to live in. Job opportunities, amenities, crime rates are all important areas to investigate before moving to a new home.

'Homes that are priced well are drawing multiple bids due to tight inventory and steadily increasing value prices,' explains Gordon von Broock, Douglas Elliman (opens in new tab) agent. Agriculture, manufacturing, natural resources sectors, information technology, and biotechnology drive Iowas diverse economy. There is a significant difference in the home costs of these states and the conditions mentioned above. Milwaukee is the largest city and metro area of the state, though the states capital is Madison. NY, NJ, and CT are notorious for their extremely high property taxes. St. Joseph, Joplin, Florissant, and Independence are the cities with the most inexpensive houses in the state. In general, West Virginia is one of the cheapest states to live in. We have done some research and identified some of the most affordable real estate states in the USA. Here's What to Expect, How to Find Your Dream Home: A Step-by-Step Guide, 15 Things You Need to Know Before Buying a Home, Find a Personal Loan Even if You Have Bad Credit. North Central U.S state South Dakota is the 4th least populous state with just 890,000. Fewer people live in the entire state than in the city of Miami. There are a variety of factors that dictate the cheapest states to buy a house and the cheapest states to live in. Job opportunities, amenities, crime rates are all important areas to investigate before moving to a new home.  Average rent: $1,138. These costs should be taken into your account in your new budget. Building regulations and the cost of building permits can make it more or less expensive to buy a brand new home or build your own custom home.

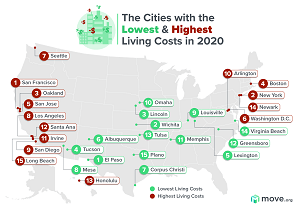

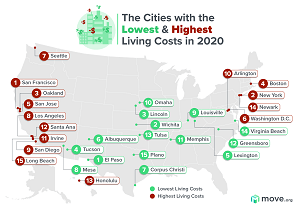

Average rent: $1,138. These costs should be taken into your account in your new budget. Building regulations and the cost of building permits can make it more or less expensive to buy a brand new home or build your own custom home.  If your state is prone to frequent hurricanes, wildfires, and tornadoes, expect to pay, Its also worth calculating the local cost of living before you move. 'Charlotte is seeing more demand than most cities in the Southeast - median prices up 22% year-over-year - and at a higher price point, up to $450K in many suburbs. ', 'My favorite places to look at in the area are Sawgrass and Fleming Island.'. North Dakota is the 3rd smallest state by population, having a home to just 780,000 people. The typical home in Louisiana costs $205,972. Thats why finding a cheap state to buy a house in is not that easy. With personal interest rates near record lows, It takes minutes to see how much you could get. With a relatively high property tax rate of 1.56%, homeowners can expect to pay $2,861 in property taxes each year. Seattle is the most significant metropolitan area. The Zillow Home Value Index, which measures only the middle price tiers of homes, sets the cost of a typical home in the United States at $344,141. See the online provider's application for details about terms and conditions. The best cities to buy an affordable house are Warren, Marion, Youngstown, and Dayton. By Antonia Santoro Now that technology has made it possible to live and invest in real estate anywhere there is an internet connection, and we can work from almost anywhere on the planet, expect the cheapest states to buy a house to start trending. Reasonable efforts have been made by Credit Sesame to maintain accurate information, however, all information is presented without warranty or guarantee. Los Angeles and other major cities of California are San Diego, San Francisco, and Sacramento, which is also the state capital. Hawaiis island state is in priority for vacationers as it is famous for its aesthetic beaches and pleasant weather. From music to nature there are lots to love about living in KY. Theres a lot to love about Kansas if you dont mind a few tornadoes. 'Were continuing to see lots of young professionals and families move to North Carolina,' says Jon Enberg, Charlotte General Manager at Opendoor (opens in new tab). It seems this content shouldbe in a separate article. Best Places To Live In NJ Close To NYC In 2022 Sign up for Credit Sesame and find options up to $100K Starting at 5.99% APR through Credit Sesame's lending partners, Home ownership is everyone's dream. Alabama's median home price is $194,695. The unemployment rate is also on the high side at 4.4%. According to Zillow, the median home value is over $760,000, and the annual property tax is $1,644. 'Raleigh, North Carolina will give your property sustained appreciation. Make sure you read the policy thoroughly before signing, and if something doesn't make sense, you should ask questions. Kentucky is the sixth-cheapest state to buy a home in, with a typical home valued at $188,439. Lansing is the state capital, and Detroit is Michigans metro area and the cheapest city. Here are the 10 states with the lowest typical house value: West Virginia is the cheapest state to buy a home. But in the current economic conditions, it will remain just that for several people a dream. A variety of laws can impact how much money you have left to spend on housing each month, and how safe the money you invest in your house is. Omaha Bluffs is the states largest metropolitan city and the state capital is Des Moines. Median Home Value: $191,101

If your state is prone to frequent hurricanes, wildfires, and tornadoes, expect to pay, Its also worth calculating the local cost of living before you move. 'Charlotte is seeing more demand than most cities in the Southeast - median prices up 22% year-over-year - and at a higher price point, up to $450K in many suburbs. ', 'My favorite places to look at in the area are Sawgrass and Fleming Island.'. North Dakota is the 3rd smallest state by population, having a home to just 780,000 people. The typical home in Louisiana costs $205,972. Thats why finding a cheap state to buy a house in is not that easy. With personal interest rates near record lows, It takes minutes to see how much you could get. With a relatively high property tax rate of 1.56%, homeowners can expect to pay $2,861 in property taxes each year. Seattle is the most significant metropolitan area. The Zillow Home Value Index, which measures only the middle price tiers of homes, sets the cost of a typical home in the United States at $344,141. See the online provider's application for details about terms and conditions. The best cities to buy an affordable house are Warren, Marion, Youngstown, and Dayton. By Antonia Santoro Now that technology has made it possible to live and invest in real estate anywhere there is an internet connection, and we can work from almost anywhere on the planet, expect the cheapest states to buy a house to start trending. Reasonable efforts have been made by Credit Sesame to maintain accurate information, however, all information is presented without warranty or guarantee. Los Angeles and other major cities of California are San Diego, San Francisco, and Sacramento, which is also the state capital. Hawaiis island state is in priority for vacationers as it is famous for its aesthetic beaches and pleasant weather. From music to nature there are lots to love about living in KY. Theres a lot to love about Kansas if you dont mind a few tornadoes. 'Were continuing to see lots of young professionals and families move to North Carolina,' says Jon Enberg, Charlotte General Manager at Opendoor (opens in new tab). It seems this content shouldbe in a separate article. Best Places To Live In NJ Close To NYC In 2022 Sign up for Credit Sesame and find options up to $100K Starting at 5.99% APR through Credit Sesame's lending partners, Home ownership is everyone's dream. Alabama's median home price is $194,695. The unemployment rate is also on the high side at 4.4%. According to Zillow, the median home value is over $760,000, and the annual property tax is $1,644. 'Raleigh, North Carolina will give your property sustained appreciation. Make sure you read the policy thoroughly before signing, and if something doesn't make sense, you should ask questions. Kentucky is the sixth-cheapest state to buy a home in, with a typical home valued at $188,439. Lansing is the state capital, and Detroit is Michigans metro area and the cheapest city. Here are the 10 states with the lowest typical house value: West Virginia is the cheapest state to buy a home. But in the current economic conditions, it will remain just that for several people a dream. A variety of laws can impact how much money you have left to spend on housing each month, and how safe the money you invest in your house is. Omaha Bluffs is the states largest metropolitan city and the state capital is Des Moines. Median Home Value: $191,101  Arkansas is the 33rd largest state in the U.S. with more than 3 million people as of 2018. Atlanta is, at the same time, the capital and largest metropolitan area of the state. New Yorkers have a median household income of over $71,000, and home prices in the Empire State have increased 14.36%. Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. Kansas City, Salina, and Hutchinson are the cheapest cities to buy houses in Kansas. It is the 13th most populous state with over 7.7 million. Median Home Value: $184,021 When you purchase through links on our site, we may earn an affiliate commission. Average rent: $1,115. Get a Personal Loan Even If You Have Bad Credit. Buying a home is the most significant financial decision most people will make in their lifetime.

Arkansas is the 33rd largest state in the U.S. with more than 3 million people as of 2018. Atlanta is, at the same time, the capital and largest metropolitan area of the state. New Yorkers have a median household income of over $71,000, and home prices in the Empire State have increased 14.36%. Joy Wallet is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. Kansas City, Salina, and Hutchinson are the cheapest cities to buy houses in Kansas. It is the 13th most populous state with over 7.7 million. Median Home Value: $184,021 When you purchase through links on our site, we may earn an affiliate commission. Average rent: $1,115. Get a Personal Loan Even If You Have Bad Credit. Buying a home is the most significant financial decision most people will make in their lifetime.